Japan’s Economic Miracle 13

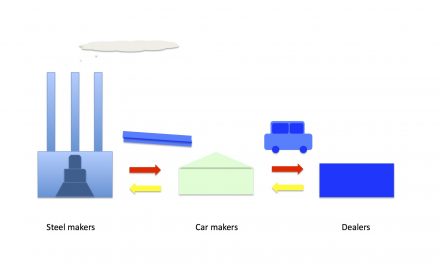

The US trade deficit which had accumulated massively of those days. In particular, the most severe case was a trade conflict between the U.S and Japan. The car import from Japan had increased drastically back then. Therefore, the U.S required Japan to lead strong Japanese ¥ and the financial liberalization.

Implementing the reduction in the official bank rate could make capitals flow into banks easily, and then the

Nevertheless, the States kept putting pressure on Japan to implement it more and more. Therefore, the Bank of Japan got a lot of criticism that it should be avoided.

Yasushi Mieno, the Vice-Governor of the Bank of Japan in those days, talked about the actual situation in an internal document in his lifetime.

Sponsored Link

A New Fact

A new fact had come to light. The Governor of the Bank of Japan, Sumida, was convinced by Mieno that the reduction of the official bank rate should not occur.

Mieno thought the sharp appreciation of land price was unrealistic and sort of money game was happening in a lot of markets.

Therefore, he believed that it would be impossible to raise the official bank rate in terms of the domestic economy. However, on October

He decided to go ahead with

On the same day, the top of the Ministry of Finance Miyazawa issued a joint statement with the Secretary of Treasury Baker. Japan and the U.S reached an agreement on the matter of advance in strong yen and the reduction in the official bank rate. That means that the U.S promised to support Japan to suppress the strong currency, but

The Secretary of Treasury Baker

Even though the Ministry of Finance didn’t have a right to decide the reduction in the bank rate, Miyazawa incorporated it into the joint statement. There might have been a meeting between the top of the Ministry of Finance (Miyazawa) and the Governor of the Bank of Japan (Sumida).

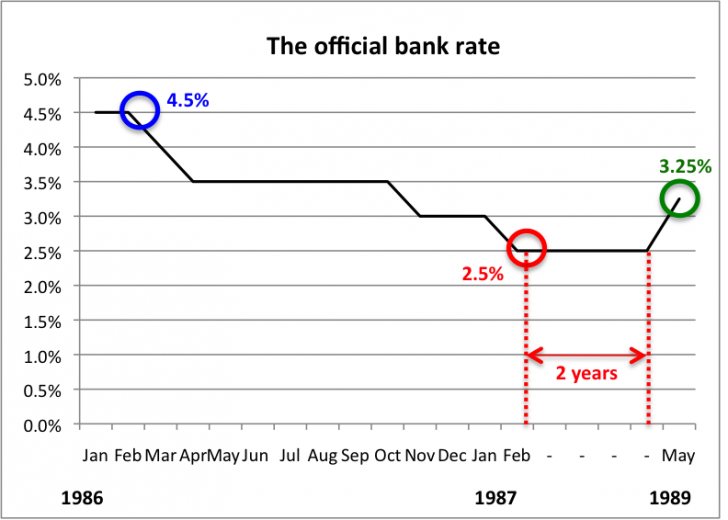

The official bank rate was reduced to 3% in November 1986 and to 2.5% in February 1987, which was the lowest level since the end of the second world war. The financing to real estate businesses got spurred more and more and the land price in Tokyo went up sharply.

In addition, it started to happen not only in the

Black Monday

However, just after the argument started, in 1987 October, the Black Monday attacked the N.Y market. The stock price crashed and it brought a domino effect from the U.S to Japan to the world.

Back then everyone in the Bank of Japan felt like the idea of raising the bank rate would cause confusion in the financial market. Therefore, the mood of raising the rate disappeared totally.

After all, the Bank of Japan did not raise the official bank rate for 2 years. In 1989 May, it was raised to 3.25%. Until that day, the bubble began expanding.

On December

January 1990

In January 1990, something unusual started happening in the Tokyo stock market. The stock price changed to declining. Hanwa, which had promoted Zaiteku, made

In November 1999, Yamaichi spent hours on capturing new customers and the promotion of Nigiri had continued to hide losses.

On November

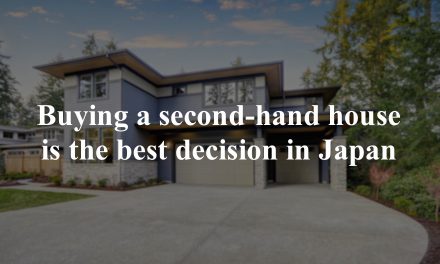

The land price also crashed. This was because the Bank of Japan raised the official bank rate and the regulation of the total amount of financing to real estate businesses was implemented by the Ministry of Finance.

Photo: Fujifotos/AFLO

As a result of this, banks changed their tunes (stopped providing loan services). Azabu Building

To be continued …

Sponsored Link